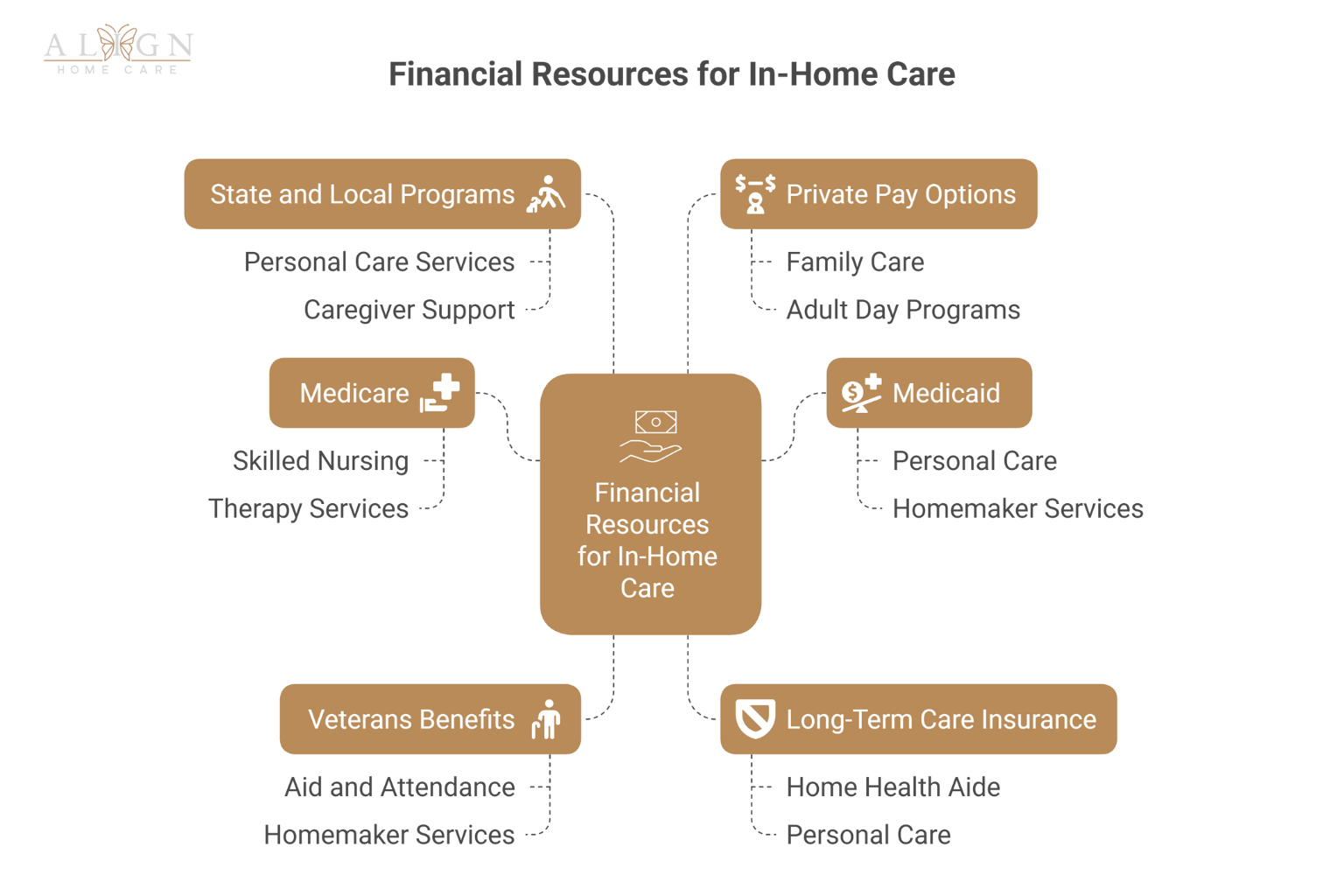

Senior home care services can be expensive, but families don’t have to navigate these costs alone. Multiple funding sources and assistance programs exist to make high-quality home care accessible and affordable for older adults who want to age in place.

Medicare Coverage for Home Care

Medicare provides limited coverage for home care services under specific circumstances. To qualify, seniors must be homebound and require skilled nursing care or therapy services prescribed by a physician.

Medicare Part A covers:

- Skilled nursing visits

- Physical, occupational, and speech therapy

- Medical social services

- Home health aide services (when receiving skilled care)

Important limitations include that Medicare doesn’t cover 24-hour care, meal preparation, or personal care services that don’t require medical training. Coverage is also temporary, typically lasting only as long as skilled care is medically necessary.

Medicaid Home and Community-Based Services

Medicaid offers more comprehensive home care coverage than Medicare, particularly through Home and Community-Based Services (HCBS) waivers. These programs help seniors avoid nursing home placement by providing care at home.

Medicaid may cover:

- Personal care assistance

- Homemaker services

- Adult day care

- Respite care for family caregivers

- Home modifications for accessibility

Eligibility requirements vary by state but generally include income and asset limits. Some states offer Medicaid programs specifically designed for seniors who need nursing home–level care but prefer to remain at home.

Your loved one’s home care needs could vary according to his or her ability to accomplish everyday tasks. There are a variety of reasons family caregivers should consider respite care. Portland, ME, families often have additional responsibilities that make it more challenging to provide the care their senior loved ones need and deserve. A professional home caregiver can take over your important caregiving duties, allowing you more time to focus on yourself.

Veterans Benefits for Home Care

Veterans and their spouses may qualify for home care benefits through the Department of Veterans Affairs. The Aid and Attendance benefit provides additional monthly payments to cover home care costs.

Veterans benefits include:

- Improved pension with Aid and Attendance

- Homemaker/home health aide services

- Adult day health care

- Respite care

To qualify, veterans typically must have served during wartime, meet income requirements, and demonstrate a need for assistance with daily living activities. Surviving spouses may also be eligible for these benefits.

The type of homecare seniors need can vary. Some need assistance a few hours a day, while others require more extensive around-the-clock assistance. At Align Home Care Services, we tailor our care plans based on each senior’s individual care needs, and the plans can be adjusted at any time.

Long-Term Care Insurance

Long-term care insurance policies purchased earlier in life can significantly offset home care expenses. These policies are designed specifically to cover services that health insurance typically excludes.

Coverage often includes:

- Home health aide services

- Personal care assistance

- Homemaker services

- Adult day care programs

Policy benefits vary widely, so families should review coverage details carefully. Some policies require care needs to persist for a specific period before benefits begin, while others have waiting periods or benefit caps.

State and Local Assistance Programs

Many states offer additional programs to help seniors afford home care services. These programs often have different eligibility criteria and may serve as supplements to federal programs.

Common state programs include:

- State-funded personal care services

- Family caregiver support programs

- Emergency home repair assistance

- Utility assistance programs

- Transportation services

Local Area Agencies on Aging can provide information about specific programs available in each community. Some programs operate on sliding fee scales based on income, making them accessible to middle-income families who don’t qualify for Medicaid.

Private Pay Options and Financial Strategies

Families paying privately for home care can explore several strategies to manage costs effectively. These approaches stretch budgets while maintaining high-quality care.

Financial strategies include:

- Combining family care with professional services

- Using adult day programs to reduce home care hours

- Exploring shared care arrangements with other families

- Investigating faith-based or community volunteer programs

Some families also consider reverse mortgages or life insurance policy loans to fund home care expenses. Financial advisors can evaluate these options based on individual circumstances.

If you have a senior loved one who needs help maintaining a high quality of life while aging in place, reach out to Align Home Care Services, a leading provider of senior care Portland families can trust. Our caregivers help seniors focus on healthy lifestyle habits such as eating nutritious foods, exercising regularly, and maintaining strong social ties, and we offer mentally stimulating activities that can boost cognitive health and delay the onset of dementia. Call Align Home Care Services today to learn about our high-quality in-home care services.